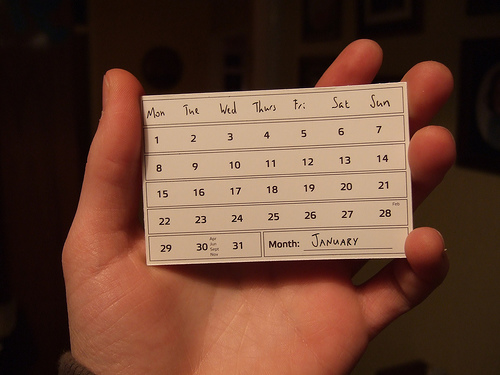

Consider delaying the filing of Chapter 13 cases where the debtor expects to owe taxes for 2010 til January. Otherwise the tax for 2010 is a post petition debt not easily payable through the Chapter 13 plan.

Consider delaying the filing of Chapter 13 cases where the debtor expects to owe taxes for 2010 til January. Otherwise the tax for 2010 is a post petition debt not easily payable through the Chapter 13 plan.

It’s December and I’m trying to be thorough in asking Chapter 13 prospects whether they will owe taxes for the current year. Income taxes are not owed until the end of the tax year. Thus a January 1 filing will include the 2010 taxes as a prepetition claim.

In the same case filed December 31, 2010, the taxes will be a post petition debt. While there are provisions in the Code for treating post petition debts in the plan, I find that it always involves resistance by the taxing authority, worried about their entitlement to penalties and interest.

Absent a countervailing reason to file sooner, I expect to hold off filing 13’s involving current year taxes til after the New Year’s champagne is flat.

Image courtesy of Joe Lanman