Remember “Where’s Waldo”? As a bankruptcy lawyer, can you pick the transfer out of the crowd? Transfer is a defined term in the bankruptcy code. Both lawyers and clients understand a sale or a gift as a transfer. But do you recognize the grant of a security interest as a transfer? I conferred in a […]

Roadmap To Car Value

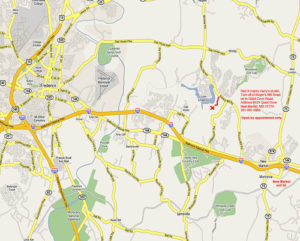

When the judge’s response to a dispute about a vehicle’s value is to hold an evidentiary hearing, you’re on stage. Do you feel like the deer in headlights ? What evidence is available? Admissible? How to get it in? The newest judge in San Jose has just written an opinion that can serve as GPS […]

The Best MCLE Hour Ever

I’ve been admitted to the bar in California for 33 years and for most of that time we’ve had a continuing education requirement of some 15 hours a year. I’ve handily exceeded that minimum every year. When I was new and a generalist, there was so much to learn; when I specialized, I found depths […]

Use The Real Tax Due Date For Means Test

Californians: did you know property taxes were due earlier this week? Huh? you say. Property taxes are due in April and December. Wrong. Property taxes are due February 1st and November 1st. They are delinquent if not paid by April 10th and December 10th. Interesting, you say. But what’s the implication for bankruptcy’s means test? […]

Differing Dollars In Chapter 13 Plan vs. Claim

Who wins when the mortgage arrearages in the Chapter 13 plan are less than the filed proof of claim? I have to admit that this has puzzled me for years, and the approaches of the three Chapter 13 trustees I practice before are different and without a an articulated theoretic basis. So I embraced a […]

On The Trail of The Involuntary Lien

If you just ask the client for a bill from each creditor, you stand to miss tax and judgment lien creditors who don’t send a monthly bill. Schedule D of the bankruptcy schedules should call out each entity with a secured claim on the debtor’s assets. Car lenders and mortgage companies are at the forefront […]

Case of the Naked Client

The bankruptcy petition came to my desk for review with no entry for “clothing and wearing apparel”. Funny, I think I’d remember if I’d interviewed any naked people lately. My new assistant has simply transcribed what the client reported on the questionnaire, and when questioned, the client shrugged that his clothing had no value, so […]