Contributions to an employer-sponsored retirement plan going forward are excluded from disposable income in Chapter 13, says the 9th Circuit in Saldana, 122 F.4th 333, 19 years after BAPCPA became law. What took so long? Words in the statute matter Congress, in its BAPCPA-typical awkward fashion, said right there, in 541(b)(7)’s hanging paragraph, that amounts […]

Re-examining The Means Test Cost of Home Ownership

The real non mortgage expenses of home ownership are nothing like the means test allowances provided. Bankruptcy lawyers need to rise to the challenge of aligning the means test with today’s economic and legal realities. The success of bankruptcy cases may turn on it. What the means test allows The means test provision for non-rent/mortgage […]

The Weak Link In The Means Test

The bankruptcy means test, designed to keep people out of bankruptcy, has a fatal weakness. Like so much recently, it’s health care. Health care, in the future, to be paid before creditors get any money. It works because, in a logic that only Congress could employ, the means test deducts future expenses from past income. And, since […]

Are 401(k) Contributions Disposable Income Or Not?

For a system that is supposed to rehabilitate personal finances and set debtors back on their feet, Chapter 13 nationwide is schizophrenic about on- going retirement savings. We’re divided about whether post petition contributions to retirement accounts preclude confirmation of a Chapter 13 plan. Are 401(k) Contributions Disposable Income Or Not? Too many courts, in […]

Marital Adjustment: Everything But The Kitchen Sink

Not every expenditure that benefits the debtor’s household or his family is a household expense. And, if it’s not a household expense, it doesn’t get added to CMI in a single spouse bankruptcy filing. That’s how the marital adjustment should work. But it’s not so simple. Household expense is not an expansive definition During a NACBA […]

Diaz & The Tax Refund

On its face, Diaz (Diaz v. Viegelahn , No. 19-50982 (5th Cir. Aug. 26, 2020)) is a pretty straightforward decision that struck down a local form plan as violating a below-median income debtor’s right to use her tax refund to finance necessary expenses for maintenance and support. On a deeper level, it appears to highlight […]

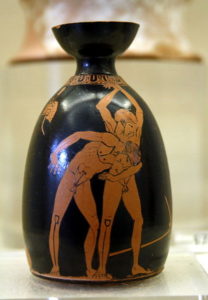

Wrestling With The Means Test

The timeless questions asked by mankind include “why are we here“, “which came first…” and “coffee or tea“. Bankruptcy lawyers wrestle with “which controls, b-22 or Schedules I and J“. My argument is: if Congress wanted a means test, then the means test controls, unless you show special circumstances. But if I minus J controls, […]