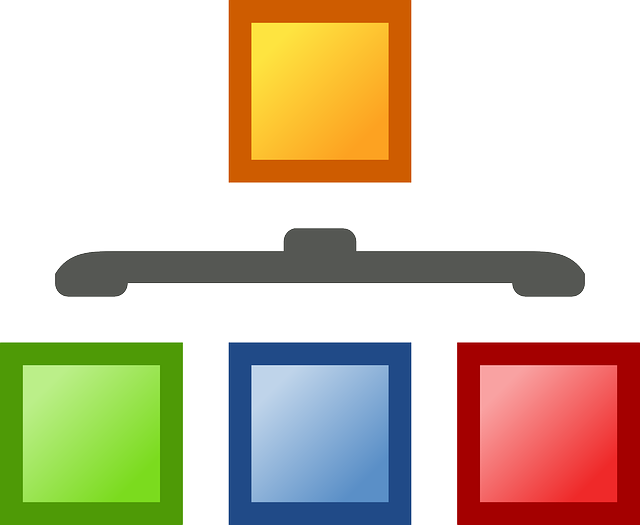

Sometimes, as an inexperienced bankruptcy lawyer, it’s hard to get your head around the idea that your client can have an asset of substantial value and not need to exempt it when filing bankruptcy.

That’s because only property of the estate is potentially available to pay the client’s creditors in a bankruptcy, and some assets, by definition, are not property of the estate. The most prominent example of value that isn’t property of the estate is a 401(k) account. It is excluded under §541(c)(2) by reason of the anti alienation provisions of the trust.

By contrast, an IRA account lacks anti alienation provisions and it is included in property of the estate. So, to retain the IRA, the debtor must use an exemption to protect the asset from creditors. Perhaps the only positive thing BAPCPA introduced was a nationwide exemption for IRA accounts up to one million dollars. See §522(n). Retention of IRA’s is no longer a problem.

Other examples of assets not property of the estate include the debtor’s interest in a spendthrift trust, since it has an anti alienation provision, and certain contributions to college savings accounts, by terms of the statute. § 541(b)(5).

So, start your analysis by determining whether the asset in question is property of the estate, and only if the answer is yes, go looking for an exemption to protect it.