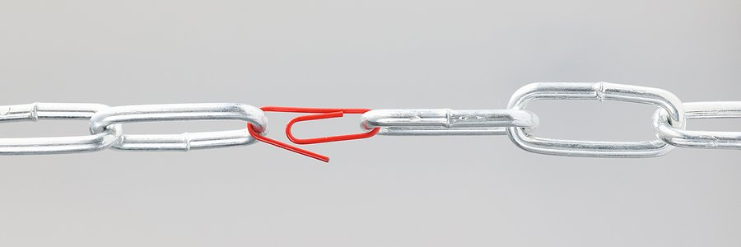

The bankruptcy means test, designed to keep people out of bankruptcy, has a fatal weakness.

Like so much recently, it’s health care.

Health care, in the future, to be paid before creditors get any money.

It works because, in a logic that only Congress could employ, the means test deducts future expenses from past income.

And, since we don’t know what the future brings, we get to “project” what those deductible expenses might be.

Project: estimate or forecast (something) on the basis of present trends

The projected future expense that swings the formula has to be health care.

Health care on the means test

Almost invariably, people with financial problems have postponed or underfunded their health care.

They haven’t seen a dentist in years; they’ve put off recommended tests or procedures. They don’t keep their prescriptions filled.

And the good news, for bankruptcy purposes, is that medical expenses is one of the categories of deductible expenses on the means test tied to actual costs.

The underlying idea is that you don’t have money to pay your creditors until you’ve taken care of your own health. You got that one right, Congress.

Means test opportunities

Health care expenses pop up in several places on the means test form.

First, the standardized expenses from the IRS collection standards have a per-person allowance available regardless of your actual expenses.

Then, among the “Other Necessary Expenses” portion of the formula, debtors can deduct future expected, unreimbursed health care expenses for themselves and their family.

Possible expenses that clients haven’t been paying because of financial troubles include

- Co pays for doctor visits

- Prescription drugs

- Insurance policy deductible

- Lab tests and screenings

- Needed procedures

- Physical therapy

- Eye exams

- Eye glasses

- Routine dental exams

- Needed dental work

- Orthodonture

- Mental health needs

- Health appliances like CPAPs, wheelchairs, oxygen

Almost everyone I meet in the course of my bankruptcy practice has some deferred bodily maintenance. Defer no longer.

Health insurance is deductible

Premiums for health insurance are deductible further down the122C-2 at line 25 in Additional Expense Deductions allowed under law.

Unlike many means test deductions, the cost of health insurance is deductible even if the client doesn’t currently have health insurance. Again, the idea is that payment to creditors is subordinate to adequate health care.

So, if the client doesn’t have insurance, or has inadequate insurance, price decent coverage, and include the monthly cost here.

Don’t forget any health insurance costs paid for dependent children away at school.

Establishing the need

Discussing the need for health care with people you’ve just met can seem invasive and perhaps insensitive. Unfortunately, that’s what we got with BAPCPA.

I try to preface my health care questions with a quick explanation of why having this information works to their advantage.

Pinning down the numbers

Getting good values for future health care costs can be a challenge. If the client has health care providers that have identified the need for treatment, that provider is the best source of an estimate. Absent that, ask Google <g>. Here are a couple of online sites that provide a range of costs for various health care services:

https://www.deltadental.com/us/en/member/cost-estimator.html

https://www.carecredit.com/dentistry/costs/

https://www.fairhealthconsumer.org/

Achieving internal consistency

The limitation on projecting health care expenses addressing all the health needs is the need to match the projected health care expenses on the means test with the projected expenses on Schedule J. The budget needs support the feasibility of the plan.

Perhaps you create the budget for health care over the course of the plan and provide for as much of it monthly as is consistent with the actual budget and the other demands of the plan. Your budget can support the on-going need for the deduction, even as some of the needed care is obtained.

For all too many of our clients, projected health care expenses are a Swiss Army knife, whittling DMI into line.

More

Maximizing the tax deduction on the means test