While we’re learning to “walk the walk”, we might as well learn to “talk the (bankruptcy) talk”. Each profession has its shorthand for concepts that are encountered repeatedly. For bankruptcy lawyers, that includes the distinction between Chapter 13 “percentage plans” vs. “pot plans“. These terms are alternative ways that the dividend to unsecured creditors in […]

Bankruptcy Exemption Mistakes Feed Trustee Coffers

Bankruptcy lawyers who mess up claims of exemptions were the other target of the trustee’s attorney I spoke with earlier this week. He rubbed his hands over attorneys who hadn’t collected enough information to understand the asset or who simply didn’t know that the homestead exemption didn’t apply to property other than the debtor’s residence. […]

Bankruptcy Contested Matters: Won by Showing Up

Sometimes bankruptcy litigation is won by simple persistence. As Woody Allen says “80% of success is showing up”. Two instances this week where being ready and willing to have a hearing on a disputed issue resulted in victory before the hearing. In my case, I had a marginal set of facts in a […]

Bankruptcy Exemptions: 10 Ways to Deal with Excess Cash

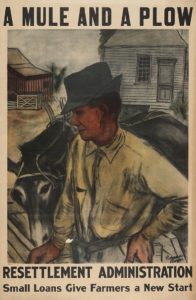

Bankruptcy lawyers occasionally are confronted with the client with more cash, or other marketable assets, worth more than the available exemptions to protect them. And state exemption systems often protect the darndest things, like a mule and a plow. A milk cow. The family bible. Those aren’t the things most of us are striving to […]

Bankruptcy’s Means Test Doesn’t Apply to All

New bankruptcy lawyers sometimes forget in the flurry over getting the means test right that it only applies when the debts are primarily consumer. Primarily means over half in dollar amount. The code defines consumer debts in §101(8) as debt incurred for a personal, family or household purpose. You may be surprised by the kinds […]

Bankruptcy Procedure Question? Ask a Clerk

The bankruptcy judge ordered me to get the signature of an absent party on the written version of the order just made from the bench. So, what to do when that party was unwilling to sign? When the judge signed the order anyway, opposing counsel complemented me on knowing how to deal with the problem. […]

Discharging Taxes in Bankruptcy: This Year’s Trap

Income taxes are dischargeable in bankruptcy if they meet the three year rule; the two year rule; and the 240 day rule. When you count back for the three year rule (the date on which the return was last due without penalty is more than three years prior to the date the bankruptcy is filed), […]