Quick: tell me all you know about FRBP 7041. Hint: it involves voluntary dismissals Maybe you’re like me and never gave it much thought. My encounter with the rule ended up at the 9th Circuit, so I now know a lot more about how it impacts bankruptcy motion practice. I concluded that the “Withdraw” event […]

Navigate The Marital Debt Thicket In Bankruptcy

Love and Marriage. Fries and Catsup. Chips and Dip. Like these famous pairings, divorce and bankruptcy are frequent companions. When a couple goes their separate ways, often the most substantial marital accumulation is debt. The questions we get as bankruptcy practitioners usually revolve around whether to file a bankruptcy case before or after the divorce. […]

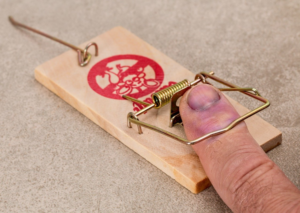

Bankruptcy and the “hard of hearing”

You never know just how a client hears your advice, until you hear yourself quoted back to yourself as the reason for a client doing something stupid. In my case, I’m unclear about whether the message received was really as reported, but it’s made me think about my choice of words. I was asked […]

Re-examining The Means Test Cost of Home Ownership

The real non mortgage expenses of home ownership are nothing like the means test allowances provided. Bankruptcy lawyers need to rise to the challenge of aligning the means test with today’s economic and legal realities. The success of bankruptcy cases may turn on it. What the means test allows The means test provision for non-rent/mortgage […]

Interspousal Claims Defy The Chapter 7 Discharge

Even when the contentions against a debtor-spouse sound in fraud, breach of fiduciary duty, or intentional tort, the claims of the debtor’s spouse survive a Chapter 7 discharge. Despite the fact that those sorts of claims against anyone other than a spouse would require a timely filed adversary proceeding to escape discharge. So held the […]

Sneak Attack On Consumer Rights

Tax code changes effective in 2018 inflicted a crippling blow to consumers who must sue to enforce their rights. And few have yet noticed. The tax deduction for miscellaneous itemized deductions under IRC Section 212 is gone. So now, consumers who prevail under statutes that award attorneys fees to the successful plaintiff are denied a […]

When Laws Collide, You Need The Right Word

As lawyers, words are our stock in trade. If we want to describe, explain, or persuade, we need to use the right word. The difference between the almost right word and the right word is really a large matter – ’tis the difference between the lightning-bug and the lightning. MARK TWAIN I was blown away […]