Chapter 7 trustees plan to sue debtor’s lawyers for undisclosed assets, I was told yesterday. In the course of discussing the flood of rookie bankruptcy lawyers into local court rooms, this veteran trustee’s counsel was licking his chops at the opportunity to make creditors whole at the expense of the debtor’s attorney. The stories of […]

Bankruptcy Contested Matters: Won by Showing Up

Sometimes bankruptcy litigation is won by simple persistence. As Woody Allen says “80% of success is showing up”. Two instances this week where being ready and willing to have a hearing on a disputed issue resulted in victory before the hearing. In my case, I had a marginal set of facts in a […]

Bankruptcy Exemptions: 10 Ways to Deal with Excess Cash

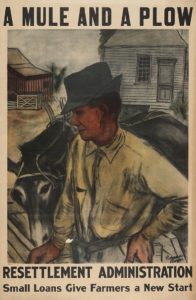

Bankruptcy lawyers occasionally are confronted with the client with more cash, or other marketable assets, worth more than the available exemptions to protect them. And state exemption systems often protect the darndest things, like a mule and a plow. A milk cow. The family bible. Those aren’t the things most of us are striving to […]

Bankruptcy’s Means Test Doesn’t Apply to All

New bankruptcy lawyers sometimes forget in the flurry over getting the means test right that it only applies when the debts are primarily consumer. Primarily means over half in dollar amount. The code defines consumer debts in §101(8) as debt incurred for a personal, family or household purpose. You may be surprised by the kinds […]

Assets in Bankruptcy Pose Valuation Issues

A bankruptcy lawyer seems to often have the unpleasant task of telling a debtor that their possessions have little value. I don’t know whether it’s a defense mechanism or just ingrained thinking, but I have clients tell me all the time that their assets have values far beyond what seems likely in the current market. […]

Bankruptcy Procedure Question? Ask a Clerk

The bankruptcy judge ordered me to get the signature of an absent party on the written version of the order just made from the bench. So, what to do when that party was unwilling to sign? When the judge signed the order anyway, opposing counsel complemented me on knowing how to deal with the problem. […]

Develop a Bankruptcy Filing Checklist

As bankruptcy lawyers, we don’t usually face the life and death situations that doctors do, but we do take our client’s financial lives in our hands. For their sakes, and ours, we want to get it right. Which is why I found Atul Gawande’s book The Checklist Manifesto compelling. The premise of the book is […]