Contrary evidence can trump the pre printed form. I saw it in a case I uncovered in updating the Complete Guide to Means Testing for the NACBA Fall Workshop. Swartzentruber ( 2009 WL 28730003 (Bankr. N.D. Ohio 2009)) dealt with means testing and the classification of debts as consumer or non consumer. The debtors there […]

Fifty Shades of Summer at Mastery

Summertime.….another Gershwin song. Maybe the living is easy, and maybe not. Bankruptcy is a challenging way to make a living. Two summers ago, when this publication and lots of bankruptcy lawyers were new, we proposed a summer reading list of Supreme Court cases that you should know by name and holding. The focus was on, […]

George Gershwin Does Bankruptcy

Cases keep getting referred to my office when the clients are over the debt limits for Chapter 13. (Debt limits are less of a barrier since the debt limit moved to $2.75 M in 2022). The assumption seems to be that if the debt is that large, a Chapter 11 is required. It ain’t necessarily […]

Best Bankruptcy CLE For Under A Buck

What bankruptcy can and cannot do for borrowers in distress is the subtitle of a free, three hour, on demand presentation by PLI. I was part of the panel that surveyed the field for new lawyers and those new to the intersection of real property and bankruptcy. Live, it was fun since all the audience […]

Bankruptcy’s Three Little Words

Like waltz tempo, there’s an appeal in threes: Larry, Moe, and Curly Faith, hope, and charity Tinkers, Evers, and Chance In bankruptcy, the trio is unliquidated, contingent, and disputed. They’re the prescribed adjectives for describing claims on the schedules. We all love adjectives, don’t we? Contingent The definition of contingent, in our context, focuses […]

Get To The Heart Of This Lien Business

When I trip over the same issue three times in a week, it’s time to discuss it here. In my office, it came up when I spotted a creditor on Schedule D with a lien on a pleasure boat. Only problem was that no boat was listed on Schedule B; it belonged to the debtor’s […]

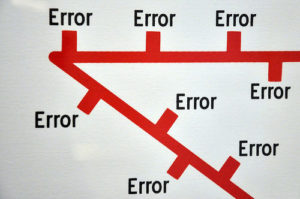

No Hits, No Runs, But Lots Of Errors

Their unconfirmed Chapter 13 case was dismissed and the unrepresented debtors sitting before the judge didn’t understand. “Why did our payments keep going up?” they asked. “We can’t pay that much”. The judge noted that their current plan called for a pot of $73,000 over the life of the plan. The trustee had the answer: […]