Is the current rotten economy and marginal job skills a circumstance for which a Chapter 13 debtor is not “justly accountable”? Or does nothing short of death or disability entitle a debtor to a hardship discharge in Chapter 13?

Is the current rotten economy and marginal job skills a circumstance for which a Chapter 13 debtor is not “justly accountable”? Or does nothing short of death or disability entitle a debtor to a hardship discharge in Chapter 13?

Yesterday’s hearing was triggered by the Chapter 13 trustee’s objection to our motion for a hardship discharge. The debtor is an independent truck driver who is surrendering the encumbered big rig because he can’t make enough money to feed the family and make the plan payments.

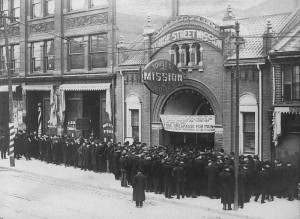

There’s a snow ball’s chance in hell that he can 1) find immediate employment that 2) pays enough to retire the nearly $20,000 in priority taxes remaining for payment over the next 23 months.

One prong of the test for entitlement to a hardship discharge is that the debtor’s “failure to complete the plan is due to circumstances for which the debtor should not justly be held accountable”. So the question: is my client responsible for the Great Recession?

The trustee’s contention was that reduction in income does not entitle the debtor to a discharge. And admittedly, the trustee’s job becomes more complex if job loss, plant shut down, or reduction in hours have to be considered in this context. Death and dismemberment are so much easier to assess. My (unvoiced) retort was “so what? you too, trustee, can do hard things.”

Before the case was called I was wondering how to get the court to take judicial notice that there’s a recession out there, and even a debtor ready and eager to work does not have assurances that work is available. Should my client be held accountable for a rotten job market.

While the court did not rule on my motion, it appears that this judge is well grounded in the economic realities of our current economy. He sent us off to supply amended schedules of income and expense, without the big rig, and for the trustee to make an argument as to how, short of winning the lottery, the debtor could make the payments required to retire the priority debt and get a full performance discharge.

What’s the attitude of the judges you practice before?