Adequate protection in operation seems to stump new bankruptcy lawyers.

Adequate protection in operation seems to stump new bankruptcy lawyers.

How does the adequate protection payment relate to the claim as a whole?

How do you figure it?

Who gets adequate protection?

The knottiest question I took at Amelia Island (and the least satisfying answer) came in the Chapter 13 plan class about adequate protection.

So, let’s take a stab at working through “adequate protection”.

Adequate protection is value provided to a secured creditor during a bankruptcy case that prevents the value of the secured claim from decreasing.

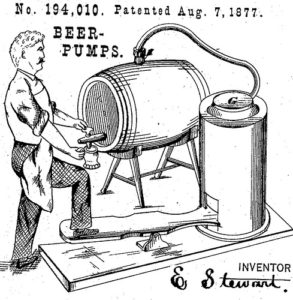

In our illustration, if you image the bartender pumping more beer (instead of air) into the barrel as he draws beer out, the beer pumped in is adequate protection. It keeps the level of beer in the barrel (or value in the secured claim) steady despite the debtor’s use.

It’s part and parcel of the greater status accorded a creditor with a security interest in the debtor’s goods.

Adequate protection in action

The classic situation for adequate protection in a consumer case involves the debtor’s encumbered car in a Chapter 13 case.

Absent a court order or the changes to the Bankruptcy Code in 2005, the debtor continues to drive the car before the stream of payments under the plan are actually disbursed. Assume the secured claim was $1000 at filing. But the passage of time and the miles driven reduce the value of the car. The secured portion of the claim is reduced with the loss of value in the collateral.

The Code thus provides in §361 the ways in which the value of the secured claim can be maintained. For cars, it’s always cash payments coupled with insurance.

The concept is that the interim payment should at least equal the amount by which the collateral is losing value.

So if our $1000 car loses value at $10 a month, adequate protection requires a monthly, preconfirmation payment of at least $10.

At the end of the first month of the case (assuming that adequate protection payments began immediately), the secured creditor has a secured claim of $990, and $10 in cash. That’s the same value as the creditor had at the beginning of the case.

How much provides protection?

The rule of thumb I have been taught is that a car depreciates 1% of its value a month. I have no idea where that formula came from (anyone?) or how it stacks up in the real world.

Notice that it’s a percentage of the value of the collateral, not the value of the claim. It’s the loss of the collateral’s value that we’re trying to mitigate.

BAPCPA brought us the requirement that the debtor pay adequate protection on purchase money claims starting 30 days from the commencement of the case and that plan payments on secured claims be equal. § 1325(a)(5)(B). Whether adequate protection is paid by the debtor or the trustee seems to be a matter of local practice.

Image courtesy of stans_pat_pix.