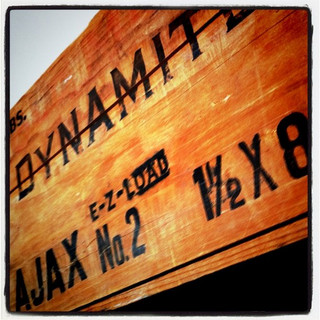

Payroll taxes are dynamite:

- they are non-dischargeable in bankruptcy

- the taxing authorities are the Big Dog among creditors

- they ensnare even people who don’t own the business

First, let’s get our terms straight. What we call “payroll taxes” are really several different taxes, FICA, income taxes, etc.

In bankruptcy-speak, we are talking about taxes that the employer collects from its employees and transmits to the government. The employer is merely a conduit for payments by others on their taxes. They are also called trust fund taxes.

When the employer fails to remit the taxes it collected, the government gives the employee credit for payment. After all, the employee didn’t get an improper benefit from the money.

The employer, however, who withheld the money from the employee and didn’t pay it over is treated as though it had stolen the money.

Thus, the debt is non dischargeable.

It is also a priority claim which must be paid in full in Chapter 13.

The quickest loan in town

The problem for our bankruptcy clients is that often, the money didn’t exist in the first place. The employer was able to scrape together the amount of the employees net checks. The payment of the balance of the gross wage was put off “til things get better”

Putting off remitting the trust fund taxes to the government is the quickest “loan” in town. No paperwork. No credit decision. Just more money in the account to deal with other, seemingly more critical bills.

Who is liable

If the business is a proprietorship or a partnership, the answer is easy: the owner(s).

If the business is an entity, corporation or LLC, the net is swung wider. Anyone who could have signed a check to pay the taxes, or who could have directed someone else to write the check is exposed.

That’s why these taxes are sometimes called the “responsible person penalty”. Anyone who was responsible for paying, and didn’t, may be liable.

The IRS, in my experience, exercises discretion in how wide to cast the net. I once got the MBA treasurer of the employer, who was shareholder, director, and signatory on the bank account, not to mention the wife of the president, out of responsible person liability. The facts were that, effectively, all such decisions were made by her husband. But you can’t count on such results.

How deep is the hole

If tax returns were filed and are available, you can find the employee taxes on the form. If all you have is a federal tax notice, I generally estimate that 2/3 of the amount owed is the trust fund portion of the debt. The balance is the employer’s contribution to FICA.

The employer’s share of FICA tax is a tax measured by wages under 507(a)(8)(D). Since it is a tax on the employer, it will become dischargeable when it meets the 3 year, 2 year, and 240 day rule.

If you suspect the individual sitting across the desk from you may have trust fund liability exposure, get a tax transcript. You must ask for CIV PEN liability on the request form. Simply asking for taxes owed by years won’t return liability that has been assessed against an individual.

Note that where the employer is a corporation, the IRS must assess the liability against any individual potentially liable for failure to pay the entity’s payroll taxes. There is a statute of limitations within which that assessment must be made.

If the entity is an LLC, different tax rules apply. If the LLC’s profits and losses flow through to the tax returns of the owners, the LLC is a disregarded entity, for IRS purposes, and the member-owners are liable for its payroll taxes. IRM 5.1.21.3.1 (10-07-2020).

Head spinning? That’s probably enough to introduce the topic and its importance when the business had employees.

Read more

Closing a business without bankruptcy– written for laymen, but useful for lawyers, at Bankruptcy in Brief.

Image courtesy of Jeff Hester

Wow! Great information. Thanks for the informative post.

Take it and USE it

Business owners who find themselves liable for unpaid payroll taxes are in deep trouble. And they need an expert lawyer to overcome this problem. The post is nice for the lawyers practicing in payroll taxes category.