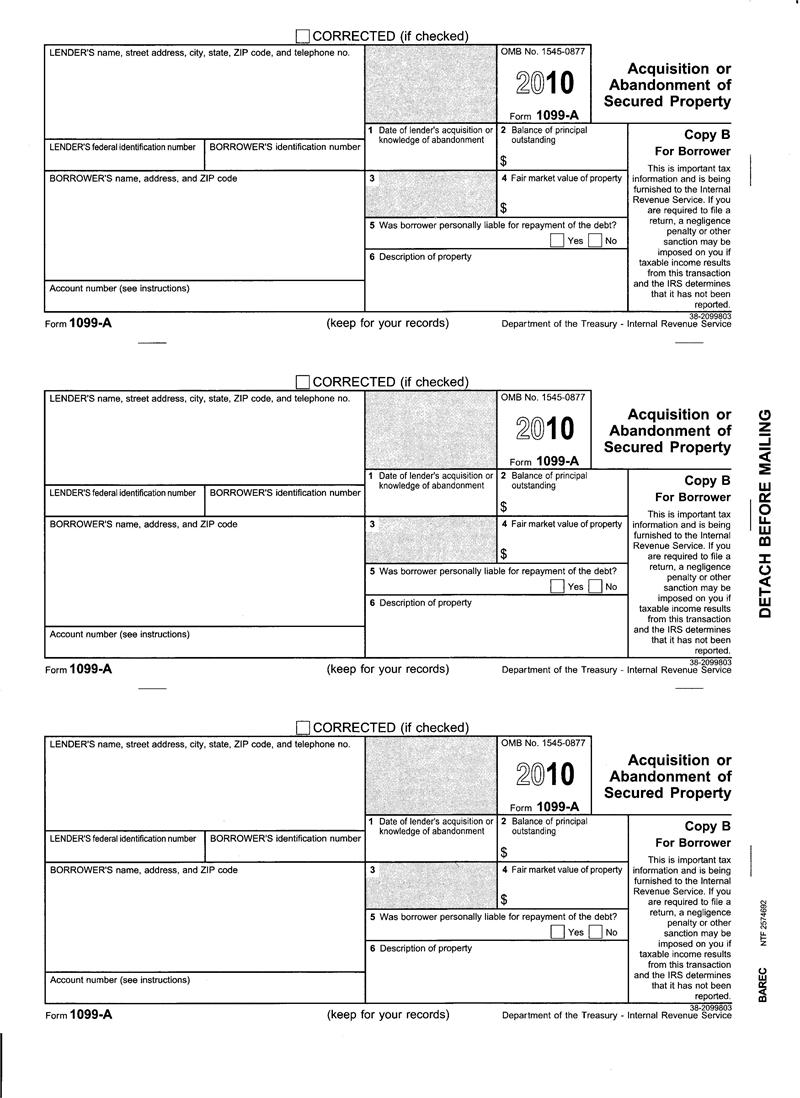

The 1099 form is so well recognized and imbued with authority that it is used by scammers to authenticate their scheme. But it’s really dangerous when genuine 1099’s are just plain wrong. And according to Bill Purdy, my go-to resource on this issue, 1099’s are often wrong.

When a non recourse loan is foreclosed, no matter what the spread between the amount of the debt and the fair market value of the property, no cancellation of debt income results. Period. If there was no personal liability on the loan, there is not even a theoretical improvement to the borrower’s balance sheet when the collateral is foreclosd.

Non recourse debt might be statutorily non recourse, as the purchase money non recourse provisions of California law; it may be non recourse by reason of a bankruptcy; or it may be non recourse because the collateral was acquired subject to the lien.

But neither the foreclosure servicers nor the banks are sensitive to or knowledgeable about personal liability as the trigger for cancellation of debt income.

The take-away for me was the need to dig behind each 1099 before concluding that I needed to have the client complete the IRS form to calculate whether COD income is includable in income.

In most tax litigation, the taxpayer has the burden of proof – that is, the IRS is presumed to have correctly come up with the audit results being litigated, and the taxpayer has to prove it wrong in court. The biggest exception to this is a deficiency based on income unreported by the taxpayer, but reported by a third party (in other words, a 1099). In that case, the IRS has to prove the income by other means (see 26 USC 6402(d)). IRS attorneys (I was one for 10 years) have your same take-away – if the Tax Court case involves unreported income, dig behind it before concluding that the deficiency can be defended.

You can challenge the 1099 to the irs and they should investigate it, problem is 1099 goes out LATER after the act the FOLLOWING YEAR and most clients give 1088 to preparer who does not know either how to challenge the 1099 or do the return correctly

IRS told a ND CA gathering of bankruptcy lawyers last year that they

wouldn’t do anything about an erroneous 1099; their position was that it

was the taxpayer’s problem. So you may end up treating the event as you

think it should be treated and defending your evaluation if challenged.

Cathy