Bankruptcy lawyers occasionally are confronted with the client with more cash, or other marketable assets, worth more than the available exemptions to protect them.

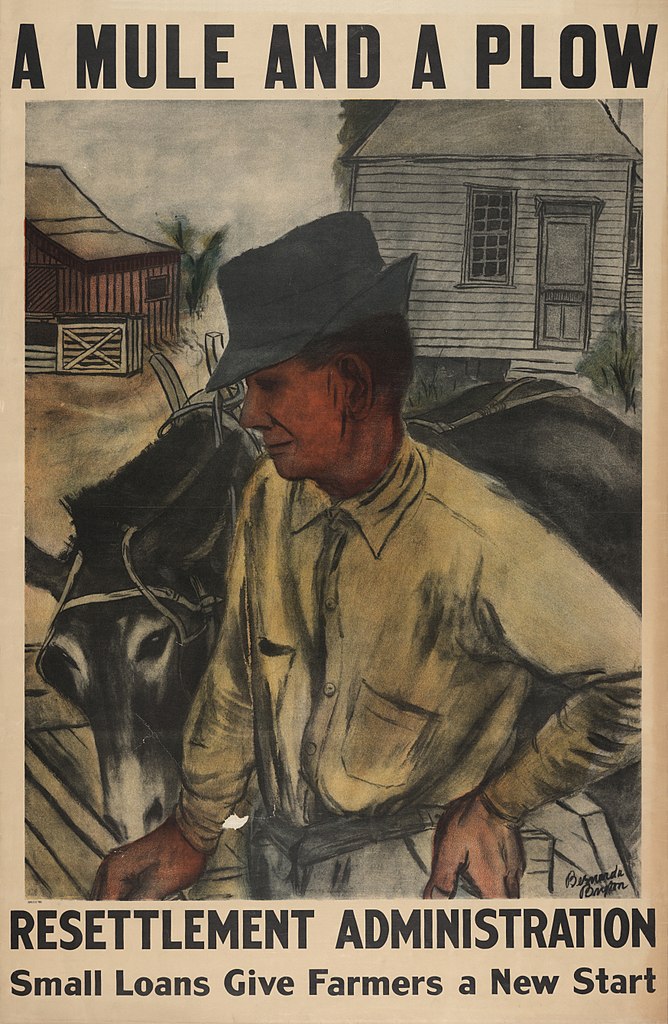

And state exemption systems often protect the darndest things, like a mule and a plow. A milk cow. The family bible.

Those aren’t the things most of us are striving to protect. So if your client has cash or cash equivalents beyond the available exemptions, read on.

Dratted cash!

Here are some ways to spend that currently non exempt cash on things that are exempt, or unappealing to a bankruptcy trustee:

- Fund IRA’s

- Obtain cash value life insurance up to exemption limit

- Repay 401(k) loans

- Buy a year’s worth of home or auto insurance

- Catch up on tax under-withholding

- Get needed medical or dental treatment

- Repair the things the client has

- Tune-up car

- Stock pantry & freezer

- Pay down student loans, delinquent support, priority taxes

Paying down the student loan will require that the client wait 90 days to file, putting the transfer beyond the preference period look back.

Look through the list of available exemptions where you practice for ways the debtor can increase the value of any asset currently worth less than the maximum exempt or acquire an asset that would be both useful and exempt going forward. ( I generally don’t advise maximizing the exemption for a mule or a plow for instance.)

Local attitudes matter

Exemption planning is an issue that is exquisitely local: available exemptions vary from state to state and the local view of what is permissible exemption planning rather than actions to hinder delay or defraud creditors vary.

None of these suggestions, in my view, push the envelope. But read some cases in your jurisdiction for a look at the prevailing attitude. Talk to veteran practitioners.

It’s your job to help the client retain as much value as they can for their fresh start.

Image courtesy of Library of Congress

Cathy, this was really helpful. With the CA wildcard exemption, I haven’t run into excess cash I couldn’t exempt but I’ve come close a couple of times. I would love to see more on exemption planning.

Sometimes, it’s not cash, but stock in the company stock purchase plan, or excess cash value in life insurance. Any place you have significant non exempt value, you can start thinking about reallocating the asset mix.

No problem putting excess cash into an existing IRA?

This is not accurate information.

Expand on your comment: what isn’t accurate? Does local law or local practice color your view?