Income taxes are dischargeable in bankruptcy if they meet the three year rule; the two year rule; and the 240 day rule. When you count back for the three year rule (the date on which the return was last due without penalty is more than three years prior to the date the bankruptcy is filed), […]

Alternative to Bankruptcy: Do Nothing

Bankruptcy lawyers sometimes forget: not everyone worried about debt actually needs to file bankruptcy. The anxiety that brings someone to your office may not be grounded in a real understanding of the rights of their creditors. I recently saw a woman drawing disability pay and looking at very substantial retirement income. It seemed unlikely that […]

Taxes Owed from Day One of New Year

April 15th is so ingrained in our thinking as Tax Day that it’s easy to forget that the tax for the previous year is owed on the first day of the next tax year. Payment isn’t due til April 15th, but the obligation exists before the return and payment are due. Why is this important […]

Beware the Emergency Bankruptcy Filing

Real danger for client and lawyer lurks in the emergency bankruptcy petition: File without all the information about the client’s assets and recent transfers and you risk getting family members sued and the client losing assets. Not to mention your loss of face or worse. Avoidable transfers Chapter 5 of the Bankruptcy Code deals with […]

Do Your Bankruptcy Schedules Tell the Client’s Story?

The last check before you file your client’s bankruptcy schedules should be a step back to see if the schedules “tell the story”. The background and the color don’t make it to schedules and SOFA, but you need to read them from the trustee’s point of view to see if they make sense and reflect […]

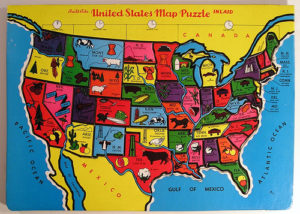

Exemption Choices for the Recently Mobile

Old and new consumer bankruptcy lawyers have a treasure in John Bates’ masterpiece on the exemption laws of each state and the availability of those laws to non residents in bankruptcy. Why do I care what the exemptions are in any state but California? The Bankruptcy Code! ( what other answer did you expect from […]

Means Test & Creditors Claims: Enough is Enough

When the means test projected disposable income number is greater than 100% of the unsecured claims, full repayment is sufficient. The means test calculation only kicks in under §1325(b) if a party objects; no one objects to repayment of everything that is owed. A new bankruptcy attorney brought me a B 22 form for a […]