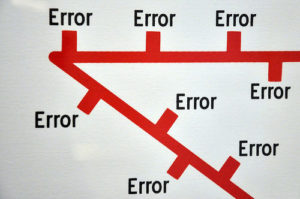

Contrary evidence can trump the pre printed form. I saw it in a case I uncovered in updating the Complete Guide to Means Testing for the NACBA Fall Workshop. Swartzentruber ( 2009 WL 28730003 (Bankr. N.D. Ohio 2009)) dealt with means testing and the classification of debts as consumer or non consumer. The debtors there bought a second residence, this one in Florida, and checked the box … [Continue reading...]