There’s nothing like a foreclosure to get homeowners to see a bankruptcy lawyer.

They are often not sure just how bankruptcy will accomplish this, but they are resolute that keeping the house is the centerpiece of their bankruptcy.

A capable lawyer can tell the client how that might be done through bankruptcy; a standout bankruptcy lawyer challenges the premise altogether.

Often these days, the fixation on keeping the house is irrational and uneconomic.

Own vs. rent

I start by walking the client through the analysis of the mortgage payment and property taxes compared to the cost of renting.

The difference between the two is the investment aspect of home ownership: you are paying more than just the price of housing in the expectation of owning something with value.

On the other side of the equation is ownership as a hedge against inflation in the cost of housing. The cost of the home loan is usually fixed, or variable only within limits. Not so, rents in the future.

Is there equity?

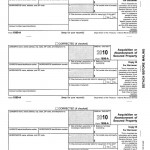

Then, we look at the difference between the current value of the house and the total mortgage debt.

Don’t forget that the mortgage debt includes the arrearages. Too often, asked what he owes on the house, the client will tell you what the principal balance on the loan is, not what the payoff totals.

The further underwater the house is, presumably the longer the client will have to pay that “investment premium” before his investment is worth even what is owed.

Funding old age

Finally, I ask the client about what he has saved for retirement. The smaller the savings and the older the client, the stronger the case that the “investment premium” in the current mortgage payment is better spent in diversified investment in something other than real estate.

The challenge of being a consumer bankruptcy lawyer is that this analysis may be strikingly different for each client and doesn’t always lead to the same conclusion.

But it is a conversation you need to have with the client.

More

Thoughts on a home as retirement savings