After the discharge, the debtor wondered how her agreement with a former business partner to pay the former partner was affected by the bankruptcy, since the partner wasn’t listed in the schedules. After wondering how the client hadn’t mentioned it and I hadn’t flushed it out, I said a prayer to St. Beezley for the […]

Case Closed: Too Soon

Do I have to wait til the bankruptcy discharge is entered to avoid a lien under §522(f)? It might be logical but do so at your peril, I replied. Actually “peril” is an overstatement, but in this date of electronic dockets, most clerk’s offices are closing no asset Chapter 7 cases just as soon as […]

Writer’s Block And The Bankruptcy Schedules

Comes the plaintive call on the phone: how do I list this? Faced with a blank schedule and a house, located in another state, titled to an estranged non filing spouse, in which the debtor may have a claim under the marital property laws of California, the rookie bankruptcy lawyer froze. I’m flattered to be […]

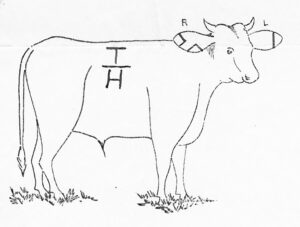

Small Business Can Be Big Trouble

The newbies in my neighborhood have had a vigorous online debate about the risks in filing Chapter 7 bankruptcy for a debtor with a proprietorship business. One faction simply refused to believe that a bankruptcy trustee could or would shut down an operating business upon filing. But real estate lawyers deemed it true. Believe it. […]

Welcome New Year

It’s 6:30 am and I’m anxious to get to my office to implement the improvements in my practice that I’ve been considering as we approach January, 2011. Isn’t one of Poor Richard’s aphorisms, “well begun is half done”? Don’t miss my friend Wendell Sherk’s piece, A Christmas Cheer for Consumer Lawyers. He captures the trials […]

Resolutions

It’s time to start considering resolutions for the New Year. I find I’m not very focused on December 31st and the idea has lost steam if I don’t line out my resolutions til mid January. In the context of a consumer bankruptcy practice, we’re probably talking about “goals” for the New Year: resolutions seems so […]

Why Earmark Tax Payments

Did you know that a taxpayer making a voluntary payment to the IRS can designate to which liability it is credited? The doctrine is called earmarking and it’s really useful when a prospective debtor owes taxes for both priority and non priority years. Absent instructions from the payor, the IRS applies payment to the oldest […]